The Board-Management Matrix - Sleeping Not Dead

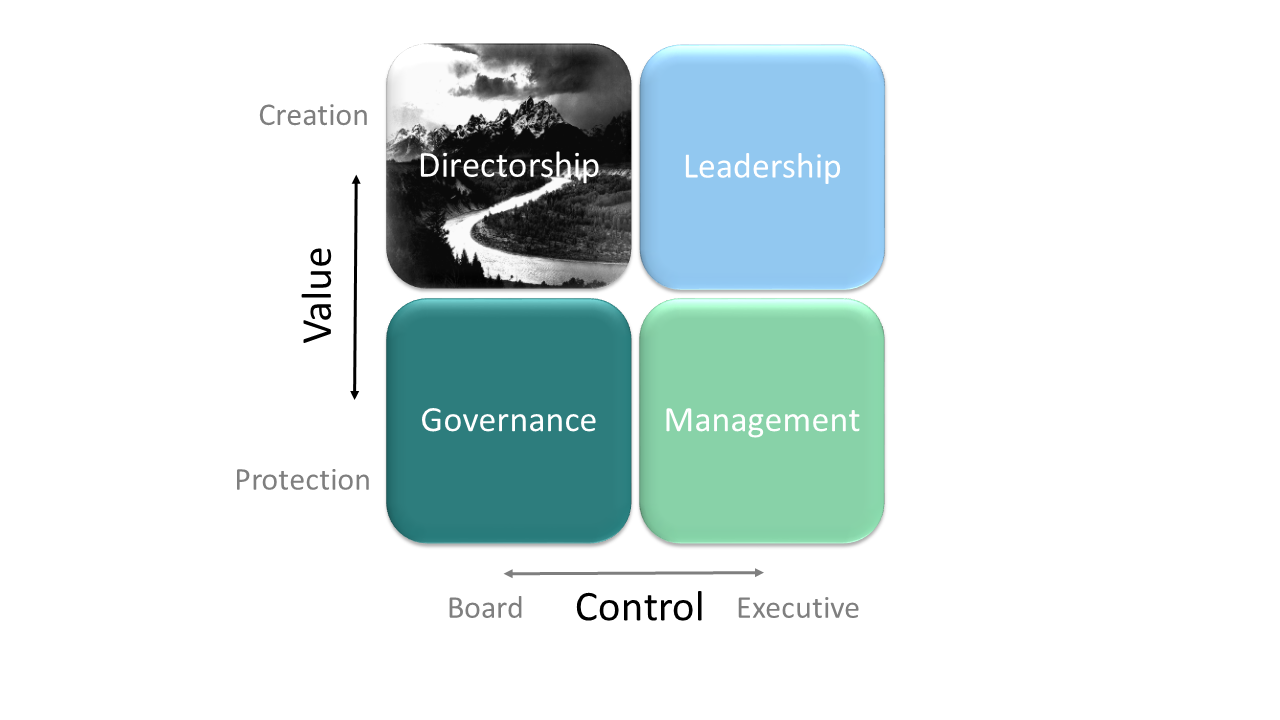

Conceived in 2012, my first 2x2 matrix was designed to visualise the work of any board and management team based on two opposing decision criteria - value creation and value protection. Incorporating the tension between leading and managing and identifying the same tension within the boardroom - directing and governing.

Value creation was something that was more spoken than practiced by directors. The product of a system that was not:

designed to create value. The set of corporate governance principles and practices we call "best practice" is producing too many “governors” focused on protecting value and not enough directors focused on creating it. Public companies have become over governed and under directed because corporate governance regulation and education is designed to ensure the "correct" board structure, process and composition rather than ensure "imagination, creativity, or ethical behavior in guiding the destinies of corporate enterprises"[vi].

But despite the model’s intuitive simplicity and focus on value, it never really caught on. It’s use never matching it’s usefulness.

I’ve wondered why.

At first, I naively thought a better explanation and reason would overcome the inertia. In more recent years, I’ve come to realise that the problem with the matrix is not that it does not make sense. Rather, the problem is that it can not make sense within the context of the mainstream theory of corporate governance.

The board-management matrix exists well outside the frame within which directors and others have been taught to understand their function and role. It was never designed to fit into the economic style of thinking that understands value in terms of profitability, and the interests of shareholders as paramount to corporate governance. And it’s even less useful to those who believe that corporations must act in the interests of their stakeholders.

Instead, the model was based on four grounded assumptions:

directors do more than just govern;

directors and executives need to work as a team;

value is measured in usefulness and not dollars; and

usefulness is the measure of a corporation’s best interest.

A set of concepts that are fundamentally opposed to the standard model of corporate governance and the corresponding exchange theory of value from which it drawn. All the power of the board-management matrix is somehow lost on a profession that, over the course of my lifetime, has been reduced to finding new ways to solve imaginary economic problems based on “best practice”.

conflict of interest between the managers, motivated by self-interest, who are expected to act in the best interest of so called owners; and

inefficiency in corporations, markets and now civil society;

maximising profits and GDP.

Solutions that quietly keep economists in control of corporate governance by enclosing the discipline within what feels like impermeable assumptions about the nature of corporate reality. And, the implausible idea, that social purpose can be realised by blindly focussing on profits without any regard to whether those profits are in anyway more useful to society than that which is destroyed in the making.

But in drawing attention to a different concept of value and the boards greater role in securing it, I had found myself on the wrong side of the history of value. The board-management matrix is as far away from “best practice” as can be imagined. The model is therefore at best an exotic novelty, and at worse, a nuisance reminder that there is an alternative.

But, theories of value sleep long, out live their welcome and die quickly. My hope is that we’re living through the last days of the exchange theory of value that has so narrowly conceived the purpose of the corporation and of its directors. If we survive, a new theory of value will awake to influence and organise society in the image of its concepts and beliefs. And, if that theory is based in value in use, the board-management matrix will finally be on the right side of value. Ready to do the work of recapitalising the planet.

In the meantime, here’s the evolution of the idea and the direction I’ll be taking it later this year.

Version 1.0 - 2013

The first version of the board management matrix was intended to speak for itself.

The matrix did not catch on.

VERSION 2.0 - 2014/15

In 2014 , I shifted things around and gave the board-management matrix a name - the DLMA Matrix . An acronym made up of Directorship ,Assurance (replacing governance in name only) , Leadership and Management.

DLMA (pronounced dillema) was catchy by did not catch on.

Version 3: 2016

I added a metaphor in 2016. How many times had I heard a director say:

“he (and it was most often a he) can't see the forest for the trees".

Secretly I knew many would have loved to have fired back:

“and you can’t see beyond the forest from behind the trees.”

The metaphor was designed to highlight the problem that “good governance” and the focus on monitoring “what if” made it hard, if not impossible, to imagine what a company (let alone the executive before them) could be.

The metaphor did not catch on.

Version 4 - 2016

Along with the metaphor, came a new version of the board-management or now DLMA matrix. A concise and condensed expression of the tension between directors in the boardroom and between boards and executives.

The new vesion caught on a little but not for long.

Version 5 - 2017

Ansel Adams’ iconic photograph of The Tetons and Snake River revealed more than perfect harmony in nature. I thought it provided a powerful metaphor for what organisations were in search of - harmony between directorship, assurance, management and leadership.

Ansel Adams did not catch on.

Version 6 - 2023

Value now appears in the centre of the board-management/DLMA matrix. Before that it was unspoken. Allowing those who used the model to import their own idea of value. All too often a $ symbol.

But that needed to change.

The source of the economist’s power over corporate governance was their control over the theory of value that informed its practices and processes. Which in turn controlled theory of the firm. Which in turn controlled the theory of corporate governance. All nested inside each other in an iron clad conceptual Russian doll. Best practice gets its power from the neo-classical theory of value that is deeply embedded within its prescriptions. Both it’s greatest strength and and vulnerability.

In late 2022, I started a project to swap out neo-classical theory of value at the core of the board-room for what I call “modern value theory”. Though it’s not modern at all. It’s more proto classical and based on the idea of value in use or usefulness. As Aristotle made clear, exchange is a kind of use and not, as economics would have us believe, a type of value. Modern value theory is a supply theory of value and argues that social purpose is realised when systems generate things that are useful for systems.

My work leads me to adopt Φ or the Greek letter “phi ” at the core of the matrix. Φ represents the idea that value is better understood as “value in use” or usefulness. Associated with available energy in physics, it was natural to use it to express value in use.

My work also leads me to conclude that economists like Milton Friedman have fundamentally misunderstood the nature of value and its relationship to the firm. Directors and managers should be creating and protecting the production of value in use not simply profits. Profits are a store of value in use. But at some point, far from the most useful and, paradoxically almost useless once too much is accumulated.

Things with greatest Φ are easily identified. They are the things that are too valuable to lose the use of - social licence, reputation, intellectual property and the people who create these. Things can be used to do usefulwork over and over. Moreover, unlike a $ that can only be used once, these things or capitals increase their usefulness through use. .

Φ did not catch on.

Version 7 - 2025

It’s no exaggeration to say that the planet has experienced what can be described as a collapse in useful things since I first drew the first board-management/DLMA matrix. The number and variety of things available and accessible to do the work of flourishing are in decline. Put simply we have a lot more money but we can do less with it.

A big part of the problem is that when value is understood in terms of exchange or instrumental value, such as profits and products, corporations tend to do three deeply anti-social things:

animate useful things tend to be transformed into inanimate less useful things

those inanimate less useful things are transformed into profits that, at some point have little or no use to the corporation

those unuseful profits are then given to shareholders, who tend to accumulate even more shares. Porous things that, when markets collapse, become less useful. Exchangeable only for a fraction of what they were bought for.

It all vanishes. At each stage, value in use is used up to create something increasing less useful. No work can be generated from that which no longer exists.

Science has a word for this - entropy. It’s the energy that is unavailable to do work within a system and its not something to be protected or created. A similar thing is going on within corporations. It’s a kind of entropy that I call counter value”. Represented by the black theta Θ, at some point corporations started producing more counter-value than value in use. The net result also needed a new word - decapitalisation.

The next evolution of the board-management matrix will do as Milton Friedman suggested and focus on profit maximization and protection. Focusing on how corporations that focus on profits eventually start to generate counter value Θ rather than value Φ. The ancient Greeks and Romans associated the black theta with death and we should too. .

Although, the board management matrix was intended as a kind of cognitive framework to help boards create value. I’m coming to realise that it might be put to work as a way to visualise how directors generate counter value by creating and protecting profits at the expense of usefulness. Explaining why maximising profits can lead to more money but overall down value. More things with instrumental value and less things with value in use.

Even the board is less useful. On the profit maximization timeline, directorship never becomes a thing that director do.